Introduction

For over a decade, Capital Markets have integrated Artificial Intelligence in various forms: price prediction, fraud detection, algorithmic trading, and automated reporting. Today, a new phase is beginning with the emergence of Agentic AI—a generation of intelligence capable not only of analysing data but also of acting autonomously and adapting to shifting market conditions.

According to Mordor Intelligence, this market could reach $41.3 billion by 2030. Gartner already ranks it among the top strategic technology trends for 2025, while McKinsey describes it as “the new frontier of Generative AI.” These signals indicate that the coming transformation is no longer just about process automation, but about the ability to orchestrate complex decision-making.

In finance, this distinction is vital. Markets move at a pace that even the most advanced systems struggle to match. Agentic AI could become an intermediate intelligence layer, capable of analysing, anticipating, and executing actions based on defined business objectives.

These intelligent agents act as true digital collaborators. They are already capable of aggregating data from multiple sources, identifying anomalies, drafting market analyses, or adjusting execution strategies. Early prototypes suggest a new era where AI systems learn from their interactions and cooperate seamlessly with humans.

In Capital Markets, the goal is not to delegate the final decision, but to expand responsiveness and analytical depth. Positioned between automation and human judgement, Agentic AI paves the way for a hybrid intelligence model—one that is more adaptive, more fluid, and more demanding in terms of governance.

Understanding Agentic AI and its Core Specifics

What is Agentic AI?

Agentic AI represents a major evolution in Artificial Intelligence: it is no longer just a generative tool, but a collection of agents capable of reasoning, planning, and interacting with complex systems. These agents can make decisions, adapt in real-time, and accomplish tasks autonomously, all while remaining under human supervision.

Faced with the increasing complexity of financial markets and massive data volumes, Agentic AI offers a strategic means to automate complex processes and reduce human error, while freeing up time for teams to focus on higher-value missions.

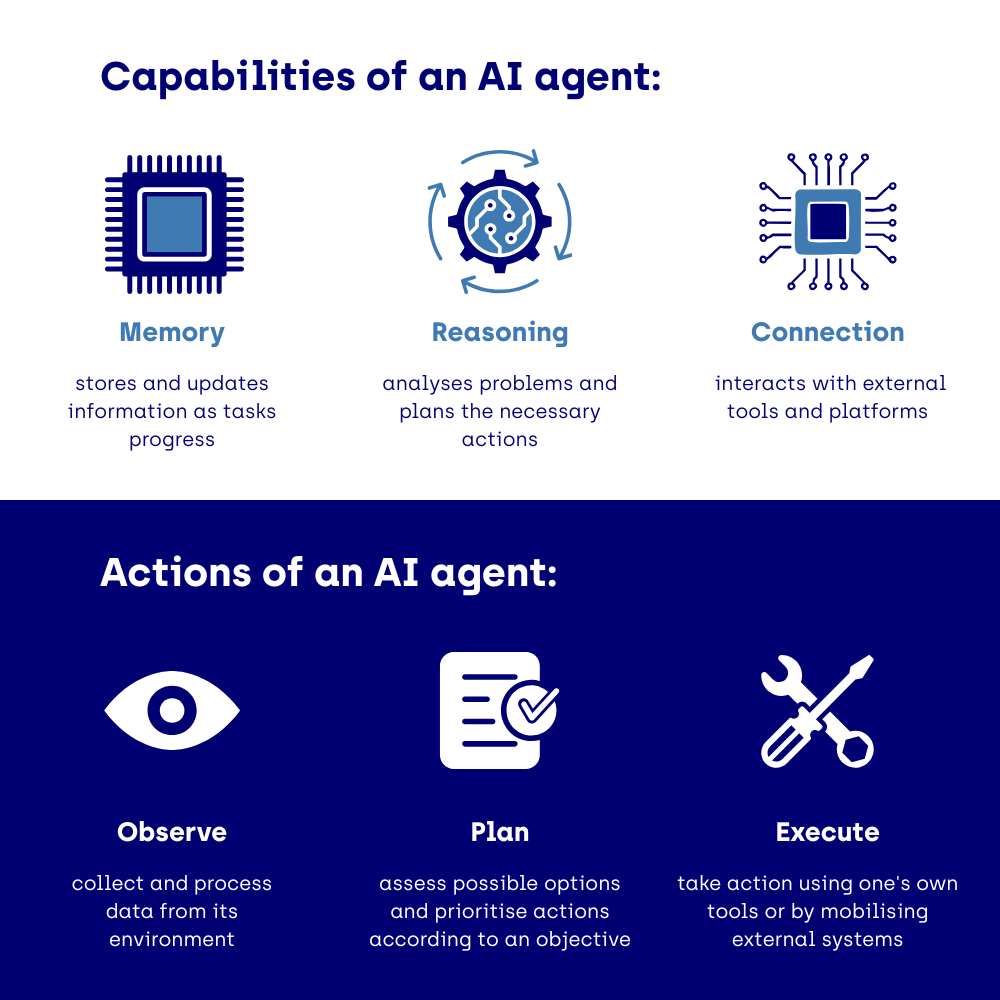

By combining memory, reasoning, and the capacity for action, an AI agent can analyse its environment, plan the necessary steps, and execute tasks autonomously.

Consequently, it becomes capable of making contextualised decisions and adapting continuously, even within complex environments like global financial markets. This approach prioritises proactivity and goal-orientation, setting it apart from traditional systems that are merely reactive or limited to content generation.

Generative AI vs. Agentic AI

While Generative AI (LLMs) focuses on producing content based on existing data, Agentic AI goes a step further: it acts. These new systems, known as intelligent agents, do not merely respond to prompts; they pursue a defined objective by mobilising various skills, accessing tools, and adapting to their environment in real-time.

In other words, where Generative AI “proposes,” Agentic AI “orchestrates and executes”. It can:

- Plan actions according to a specific goal (e.g., maximising yield or minimising risk),

- Collect the data necessary for decision-making,

- Execute operations based on rules and contextual feedback,

- And above all, learn from its mistakes to adjust its behaviour.

| Feature | Generative AI | Agentic AI |

|---|---|---|

| Purpose | Content production | Goal achievement |

| Action Mode | Reactive | Proactive |

| Interaction | Responds to queries | Initiates actions |

| Learning | Human supervision | Self-learning / Feedback loops |

| Example | Early ChatGPT versions | Salesforce Agentforce, OpenAI Operator |

The fundamental distinction lies in their decision-making autonomy. While a traditional model waits for a human request, an agent can initiate an action on its own based on the signals it perceives. This ability to reason, anticipate, and interact proactively opens up immense possibilities in Capital Markets.

In an environment where markets move in milliseconds, this responsiveness and autonomy are invaluable. An AI agent could simultaneously monitor multiple data streams—economic, geopolitical, social—to detect anomalies, simulate scenarios, or execute adaptive strategies. It becomes a dynamic interface between data and decision.

An Architecture Designed for Action

Technically, an AI agent is built upon three core pillars:

This goal-driven AI approach is what differentiates agents from traditional chatbots or assistants. Agentic AI is no longer a reactive tool but a proactive actor capable of coordinating multiple systems to achieve a specific outcome.

Agentic AI is much like building a team: each agent has its own speciality and a precise role, and the system performs best when the coordination is well-designed.

Concrete Applications of Agentic AI in Capital Markets

Optimising Trading Strategies and Order Execution

In a market where every millisecond counts, Agentic AI offers unprecedented capabilities for analysing data streams and executing orders autonomously. These agents can:

For instance, certain prototype agents can be connected to trading platforms to make decisions based on specific objectives, while remaining under human supervision.

This autonomy not only reduces reaction latency, but also decreases manual errors and frees up traders for higher-value tasks.

Their greatest strength is their ability to integrate directly into the tools that teams use daily. When the ecosystem is open—via APIs or, ideally, the MCP protocol—these systems do more than just automate tasks: they transform how teams work.

Risk Monitoring and Compliance

Capital Markets require constant risk management and strict adherence to complex regulations, such as MiFID II or reporting requirements.

Agentic AI can assist by:

- Monitoring suspicious transactions and detecting anomalies in real-time,

- Automating the production of compliance reports,

- Analysing positions and portfolios to anticipate potential risk scenarios.

These capabilities turn AI agents into true co-pilots for Risk and Compliance teams, capable of processing volumes of information that would be impossible for humans to handle alone.

For example, a major global bank established an “Agentic AI Factory” with ten dedicated squads to automate the entire KYC/AML workflow—from data extraction to client profile structuring.

Market Analysis and Strategic Decision-Making

Beyond trading and compliance, AI agents can aggregate and synthesise both internal and external data to provide strategic insights for investment teams:

- Real-time tracking of macro and microeconomic news,

- Financial market sentiment analysis based on reports, social media, and official publications,

- Decision support for asset allocation or portfolio construction.

These applications enable teams to increase their responsiveness while strengthening the reliability and consistency of decisions within a complex and volatile environment.

The Promises and Pitfalls of Controlled Autonomy

Promises: Accelerating Performance and Responsiveness

Agentic AI holds significant promise for Capital Markets. Through their capacity for analysis, anticipation, and action, these agents can:

These benefits reflect a concrete reality: human teams can focus on strategic analysis, creativity, and global oversight, while AI handles repetitive tasks or high-speed arbitrage.

Limitations and Key Considerations

Despite its strengths, Agentic AI is not a “plug-and-play” autonomous system. Several limitations must be integrated into any deployment strategy:

In summary, Agentic AI does not replace humans; it becomes a proactive partner that enhances the speed, precision, and consistency of decisions. Its success depends on thoughtful, controlled integration rather than blind, mass adoption.

What I find fascinating is that this technology is not limited to automation. It truly helps fluidify interactions, strengthens collaboration, and ultimately, allows us to rethink how we design and steer AI projects.

Future Outlook and Emerging Trends

Gradual Adoption by Financial Institutions

While Agentic AI remains an emerging technology, its adoption is growing rapidly. Banks, hedge funds, and asset managers are beginning to pilot these agents to:

- Optimise internal processes, from trading operations to compliance workflows,

- Enhance strategic analysis through the automated synthesis of multiple data streams,

- Increase responsiveness to market movements and systemic risks.

According to BCG’s Davos Report, 67% of executives plan to integrate autonomous agents into their AI strategy over the next few years. Financial institutions are leveraging this to remain competitive in an increasingly fast-paced and complex market environment.

Upcoming Technological Evolutions

Agentic AI is expected to undergo several major evolutions:

- Multi-Agent Systems and Inter-Agent Collaboration: Specialised agents working in unison to orchestrate highly complex decisions.

- Generative AI Integration: Agents capable of generating reports, analyses, or synthetic content to supplement their actions.

- Hybrid Autonomous Trading: Combining human expertise with real-time AI responsiveness to execute sophisticated strategies at high speed.

- Agentic AI Factories: Large-scale deployment of agents capable of monitoring multiple data streams and platforms while ensuring regulatory compliance.

These trends indicate that Agentic AI is poised to become a central tool for competitiveness and resilience, and not just operational support.

Maturity and Key Challenges to Monitor

Despite its potential, several factors will determine the ultimate success of Agentic AI:

These factors demonstrate that Agentic AI is not a turnkey product, but a strategic partner that, when properly integrated, can profoundly transform Capital Markets.

Conclusion

Agentic AI is transforming Capital Markets by automating complex processes, enhancing decision-making, and reducing risks. These agents analyse, plan, and act autonomously, while remaining within a human-defined framework.

While challenges related to data, oversight, and cultural adoption must still be overcome, future trends point toward a progressive rollout, coordinated agents, and integration with Generative AI. This evolution suggests a future where Agentic AI becomes an increasingly central strategic player in our working lives.

As Agentic AI gradually takes its place in our professional environment, it is moving beyond the role of a simple assistant. It is becoming an ally capable of navigating complexity, anticipating needs, and augmenting our intelligence. In the years to come, it could redefine how we collaborate with technology, transform our strategic decisions, and even reshape financial professions.

For organisations, the challenge lies not only in adopting the technology, but in the ability to integrate it with discernment, support their teams, and leverage its strengths while maintaining human control. Agentic AI is not a final destination; it is an evolving partner, inviting us to reinvent our relationship with information, risk, and decision-making.

MARGO Support

MARGO supports financial players in the design and deployment of agentic AI architectures, from experimentation to full-scale production. Our experts combine technological excellence with strategic vision to secure deployments, optimise performance, and create governed augmented intelligence.

An Agentic AI Project?

How does Agentic AI represent an evolution for Capital Markets compared to Generative AI?

Agentic AI goes beyond simple content generation. It is designed to reason, plan, and act autonomously to achieve defined goals, adapting in real-time to market dynamics. It “orchestrates and executes,” whereas Generative AI merely “proposes” content, providing proactivity and learning capabilities essential in finance.

What are the primary concrete benefits of Agentic AI in Capital Markets?

It optimises trading strategies by identifying opportunities and automatically executing orders. It strengthens risk monitoring and compliance by detecting anomalies and automating reports. Finally, it enhances market analysis by synthesising complex data for strategic decision support, while reducing human error and increasing team responsiveness.

What is the role of Agentic AI for finance professionals?

Agentic AI acts as a proactive partner, allowing traders and other professionals to analyse massive data volumes in record time, execute complex actions, and focus on higher-value tasks. It frees teams from repetitive tasks and high-speed arbitrage, while improving decision precision and consistency.

Does Agentic AI aim to replace humans in financial decision-making?

Absolutely not. Agentic AI is an intelligent co-pilot, a proactive partner that supplements human expertise. Final oversight and decision-making remain human, ensuring compliance and alignment with business strategy. It creates a hybrid intelligence model, expanding responsiveness and analytical depth without substituting human judgement.

What are the future outlooks for Agentic AI in the financial ecosystem?

The future of AI in finance will likely see the emergence of collaborative multi-agent systems, deeper integration with Generative AI for enriched analysis, and the development of hybrid autonomous trading. The creation of large-scale “Agentic AI factories” capable of monitoring multiple platforms simultaneously is also a strong trend, positioning Agentic AI as a central tool for competitiveness and resilience.